Michigan Gov. Gretchen Whitmer’s $60.2-billion budget for the 2020 fiscal year is a 3.6-percent increase over the current budget and seeks to fulfill her campaign pledge to “fix the damn roads.” It also features new money for education, and would also eliminate the pension tax that took flight under Gov. Rick Snyder.

Whitmer said today, “People are tired of driving on crumbling and unsafe roads and bridges, they want to turn on their tap and know that the water is clean and safe, and they want a strong educational system that leads to opportunity and a good job.”

She and State Budget Director Chris Kolb outlined the Fiscal Year 2020 Executive Budget Recommendation to a joint session of the House and Senate Appropriations Committees today.

The first budget recommendation from Gov. Whitmer delivers on her commitment to solving problems that will make a difference in people’s lives right now, like fixing our roads, cleaning up our drinking water, and making sure every Michigander has a path to a high wage career.

The Gov. says, “I’ve heard from people all across Michigan and this budget reflects the priorities they have shared,” adding, “People are tired of driving on crumbling and unsafe roads and bridges, they want to turn on their tap and know that the water is clean and safe, and they want a strong educational system that leads to opportunity and a good job.”

The budget recommendation totals $60.2 billion, which includes a General Fund total of $10.7 billion and a School Aid Fund total of $15.4 billion. Excluding increased funding for transportation needs, the total recommended budget is up just 2.5-percent.

Budget Director Kolb says, “The fact that our General Fund remains at the exact same level it was 20 years ago says a lot about why we are facing some of the challenges we are today,” and adds, “Everyone agrees that more revenue is needed to fix our roads and I am looking forward to working with the Legislature to make that happen.”

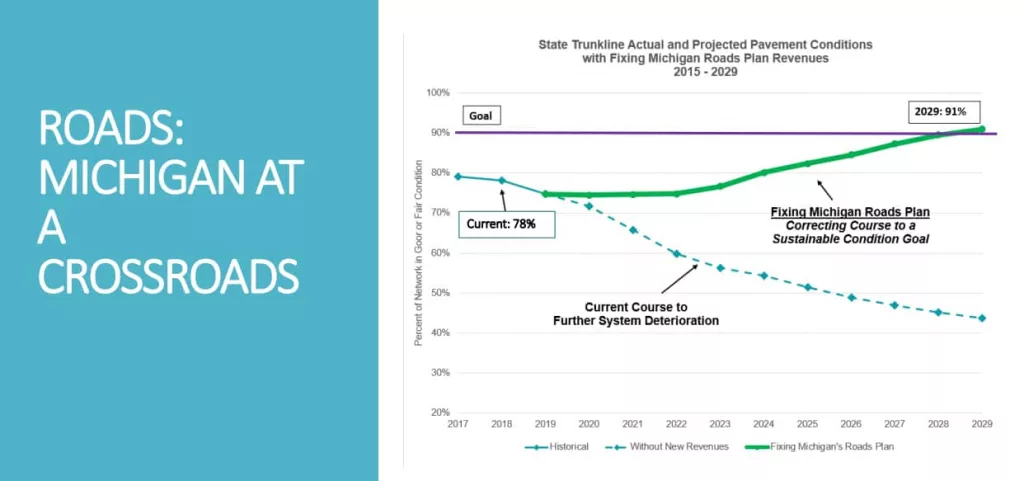

Michigan ranks near the bottom in the nation when it comes to the amount spent on highways per capita and the 2018 American Society of Civil Engineers report gave Michigan a D- on the condition of its roads. Past attempts to improve the state’s infrastructure have been unsuccessful. In 2015, a package was passed by the Legislature that only slowed the decline of road conditions and did not provide enough funding to fix the roads.

Gov. Whitmer says her budget proposal provides the necessary funding to fix the roads through three 15-cent motor fuel tax increases from October 1, 2019 through October 1, 2020, with tax relief provided to lower income, working families. The plan generates $2.5 billion in new annual revenue, which will be deposited into a new Fixing Michigan Roads Fund and allocated to our most highly traveled and commercially important roads, at both the state and local levels.

Addressing the road conditions, Whitmer says, “We have the worst roads in the country, and I am proposing a plan that will permanently fix our roads while keeping the costs fair for seniors and low-income families.” She adds, “I know this won’t be easy, but with one historic vote we can make the investments that are necessary to finally start fixing the damn roads.”

This budget recommendation is similarly focused on education and championing students through strategic investments at every stage of their education. The Governor proposes $15.4 billion for the state’s K-12 schools, with $507 million in additional investments for a weighted foundation allowance which translates to the biggest increase for school operations in a generation of students. This includes an increased foundation allowance of $235 million, which will provide additional resources of between $120 and $180 per pupil to fund basic classroom and operational expenses. The increase will also continue to close the equity gap between schools at the minimum and maximum foundation allowances, bringing the gap down to $478 per student.

Michigan serves a diverse population of students, with some children needing additional assistance or resources to help them thrive. These students may require special education services, need additional services and supports due to specific at-risk factors such as being economically disadvantaged, or need career and technical education (CTE) to make sure they are ready for the workforce. Based on the recommendations of a recent report from the Michigan School Finance Research Collaborative (SFRC), this budget includes a weighted funding system that will recognize the higher costs of educating students in these categories.

Additional funding of $120 million is included for special education students, $102 million for atrisk students, and $50 million for CTE students.

The budget recommendation also provides for an expansion of the Great Start Readiness Program in the amount of $85 million, making preschool programs available to more students across the state and improving the programs in place today. The budget plan also jumpstarts early literacy initiatives with an investment of $24.5 million to triple the number of state-funded literacy coaches in schools.

While this budget recommendation provides extra resources for students at the beginning of their education, it also encourages post-secondary success. Michigan colleges and universities would receive a 3-percent increase in funding under the budget recommendation to support learning and keep tuition increases down, with tuition restraint set at 3.2-percent. In addition, $50 million is proposed in the current fiscal year and another $50 million next fiscal year for the creation of the Michigan Reconnect Program to provide opportunities for those seeking training or certification in specialized careers, offering eligible participants tuition-free training toward their certification or credentials.

Because cyber schools don’t require the same resources and funding level as a traditional school, the budget also calls for reducing the foundation allowance for cyber schools by 20-percent.

The executive budget also addresses the immediate need for improved water and environmental infrastructure in order to keep our residents healthy and our state safe from threats of contaminants. From funding for lead poisoning prevention, to programs helping to identify oil pipeline locations and provide clean, filtered water to children at our schools, the budget puts protecting our health and safety first. Other highlights of the fiscal year 2020 Executive Budget Recommendation include:

- $13.9 million General Fund in the Health and Human Services budget to enhance monitoring of and responsiveness to the human impacts of emerging public health threats, including contaminated drinking water.

- $4 million General Fund to support the expansion of the Double-Up Food Bucks program from 65 counties to all 83 Michigan counties. Double-Up Food Bucks is a program which provides a dollar for dollar match up to $20 per day for those on food assistance to purchase fresh fruits and vegetables produced by our state’s farmers.

- $8.6 million General Fund for multiple investments in our foster care and child welfare system to protect Michigan’s most vulnerable children and keep them together with their parents when possible.

- $10.5 million General Fund to support a corrections officer academy with an expected graduating class of 408 to address higher than anticipated attrition.

- $4.5 million General Fund to support the purchase of 6,619 new electronic tether devices to improve the supervision of offenders for the Department of Corrections, as current tether devices will no longer function after this year.

- $8.6 million General Fund to support a new trooper recruit school with the anticipation of graduating 50 new troopers, maintaining Michigan State Police enlisted strength at approximately 2,100.

- $14.1 million General Fund for the Michigan Public Safety Communications System to enhance operation of the secure communications network utilized by the state’s first responders at both the state and local levels.

- Revenue sharing increases of 3 percent for counties and for cities, villages, and townships to support the operations and revitalization of local governments. Including constitutional payments, total revenue sharing payments are projected to increase by over $40 million.

- $2.3 million General Fund to continue testing and research on Chronic Wasting Disease in Michigan’s deer population.

- $450,000 General Fund for the Judiciary to expand online dispute resolution services from 16 counties to all 83 counties.

- $1.4 million General Fund for a three-year project to inventory hazardous materials pipelines that cross waterways in Michigan.

- $9.6 million General Fund to carry out functions related to the passage of proposal 2, which creates an independent citizen redistricting commission for state legislative and congressional districts, and proposal 3, which establishes several key voting rights.

- $52.9 million General Fund for 14 information technology projects to improve government operations and services to residents of the state, including projects to improve tax systems, permitting activities related to clean air and water, licensing and inspection systems, and incar video streaming for State Police troopers to enable real-time data sharing.

The budget plan also calls for nearly $100 million in reductions across all departments, creating savings that are better utilized to fund the core priorities listed above.

A new supplemental budget request for the current fiscal year was also introduced today, which includes $120 million to improve drinking water infrastructure to pursue the vision for clean and safe water for every Michigander. Funding initiatives include service line replacements, research and treatment for PFAS and other emerging contaminants, drinking water revolving fund loan forgiveness, watershed planning, and research to optimize water distribution systems. These investments set the table for a longer-term funding solution for clean drinking water in the state.

An additional $60 million from the School Aid Fund is set aside in the current fiscal year to install hydration stations in school building across the state, providing clean, filtered drinking water to students in those buildings.

The 2020 budget recommendation takes sweeping steps to ensure that revenues coming into the state’s general and school aid funds are being used for their intended purpose, “eliminating the shell games of the past.” Transportation needs are funded with predictable, constitutionally dedicated restricted funds, while public universities are funded with General Fund rather than School Aid Fund revenue. This returns $500 million in School Aid Fund resources to address the funding needs in our K-12 schools established by multiple independent studies.

The budget plan also calls for the repeal of the retirement tax, ensuring that seniors get the full benefit of the retirement they worked so hard to obtain. The lost state revenue from the full repeal of the tax is replaced by a pass-through tax on business entities that creates tax parity with traditional corporations.

The budget reflects the state’s ongoing commitment to the people of Flint, with continued funding for educational and health care services for children and adults affected by the drinking water emergency.

The Governor’s budget is built for the long term. She says the budget is structurally balanced, keeping ongoing base budget costs to the level of ongoing revenues. One-time revenues are spent on appropriate one-time purposes, including a $150 million deposit to the state’s Rainy Day Fund.

The state’s new fiscal year begins Oct. 1, 2019.

You can see the Governor’s full budget PowerPoint Presentation by clicking the link below: