An event came and went last Friday with little fanfare, but the message shared that day in some quarters bear repeating for those who didn’t hear it the first time around.

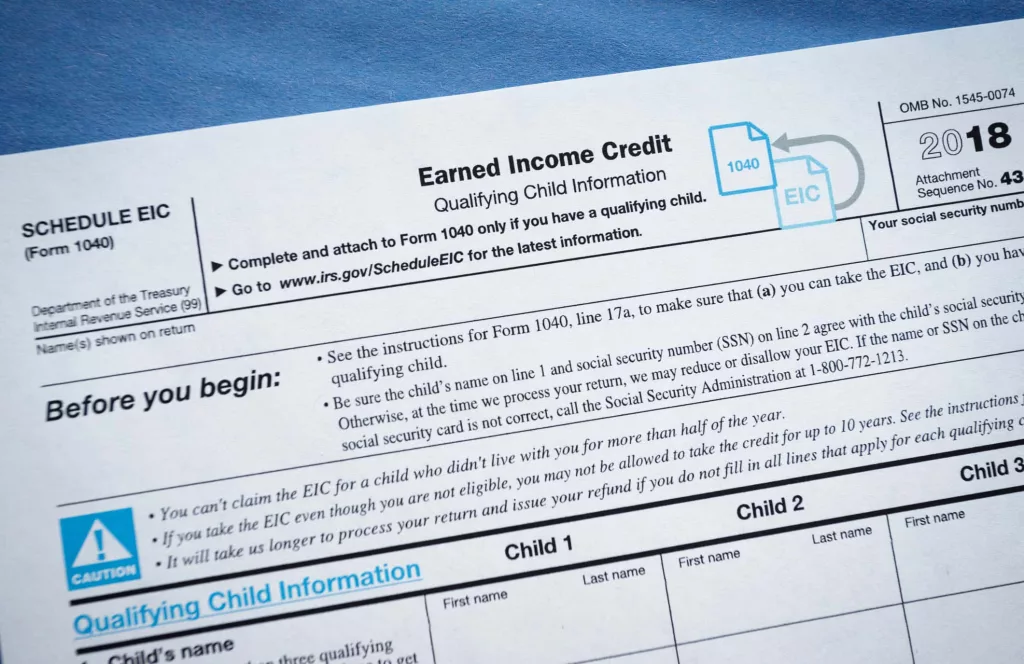

Last Friday, January 31st, was Earned Income Tax Credit Awareness Day in Michigan. The day was set aside by the Michigan Department of Treasury to remind working families and individuals with low to moderate income that they may be able to receive Michigan’s Earned Income Tax Credit (EITC).

To qualify, individuals must meet certain requirements and file a federal income tax return, even if no tax is owed or there is no requirement to file a return. If a federal Earned Income Tax Credit is granted, the state of Michigan will provide a 6-percent supplemental EITC when the taxpayer files his or her state income tax return.

State Treasurer Rachael Eubanks says, “All eligible Michiganders should seek out this important tax credit,” and adds, “The extra income this tax credit provides can be really helpful to working, low to moderate income families.”

The amount of the federal EITC depends on one’s income, filing status and the number of qualifying children claimed as dependents on the taxpayer’s federal income tax return. The EITC reduces the amount of tax owed and may provide a refund.

During the 2018 tax year, approximately 729,600 claimants received the Michigan EITC, totaling more than $109.5 million with an average credit amount of $150.

The state Treasury Department estimates there are thousands of eligible Michiganders who are eligible for both the federal and state EITCs who do not claim them each year.

To learn more about the EITC, click this link: http://www.irs.gov/eitc More information about state of Michigan income taxes can also be found at the link below: