The proposed major expansion of Whirlpool Corporation’s St. Joseph Center for Laundry & Dishwasher Technology advanced on several fronts this evening with the City of St. Joseph’s approval of an Industrial Facilities Tax Exemption Certificate that was filed by Whirlpool for their facility at 387 Upton Drive, with Cornerstone Alliance President & CEO Rob Cleveland explaining the request, and a brownfield redevelopment plan from Berrien County.

Originally, an Industrial Facilities Tax (IFT) Exemption Certificate was approved in September of 2017 for a similar project at that location, however that application included three parcels which have since been combined into one parcel. At Whirlpool’s request, the 2017 IFT Certificate was revoked last month (April 2021), because the project contemplated at that time has been superseded by the larger project which required the new application.

The property and the project are located within the Industrial Development District established by the City Commission at its regular meeting on August 28, 2017. The current taxable value of the real property is approximately $3.5 million. The IFT that is requested would be a 50-percent abatement for 12 years. However, the property is in a Renaissance Zone and for 2021, taxes will reflect only 25-percent of regular property taxes except for voted millages (in the City’s case, the CSO millage); as the Renaissance Zone phases out, in 2022 taxes will reflect 50-percent of the regular tax amount, 75-percent in 2023 and the full regular amount beginning in 2024.

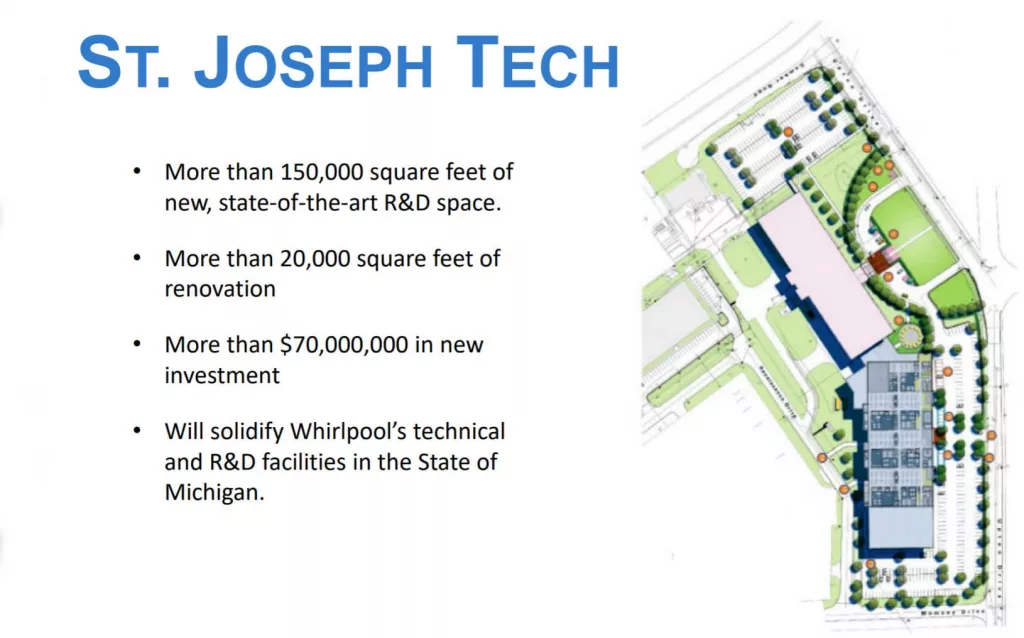

Whirlpool plans an estimated $70.6 million investment, including the construction of a new two story 153,000 square foot building attached to the northern wing of the facility, renovation of approximately 20,000 square feet of the north wing that is to remain and demolition of an existing 157,800 square foot building on the south end of the parcel. All associated site adjustments and improvements will be completed as part of the project.

Following the city’s approval tonight, the application will be submitted to the Michigan State Tax Commission for its consideration.

The city also approved a brownfield plan that went before the Berrien County Brownfield Development Authority last week.

You can read more about the proposed changes from the original story as posted here on Moody on the Market in this story: