The man who keeps close tabs on the West Michigan Industrial Economy is sharing a centuries old adage that suggests “A rising tide floats all boats.” By way of explanation, Professor Brian Long, Director of Supply Chain Management Research at Grand Valley State University goes on to say, “As the world economy continues to recover from the COVID-19 recession, the West Michigan economy has joined the parade, according to the data collected in the last two weeks of March.”

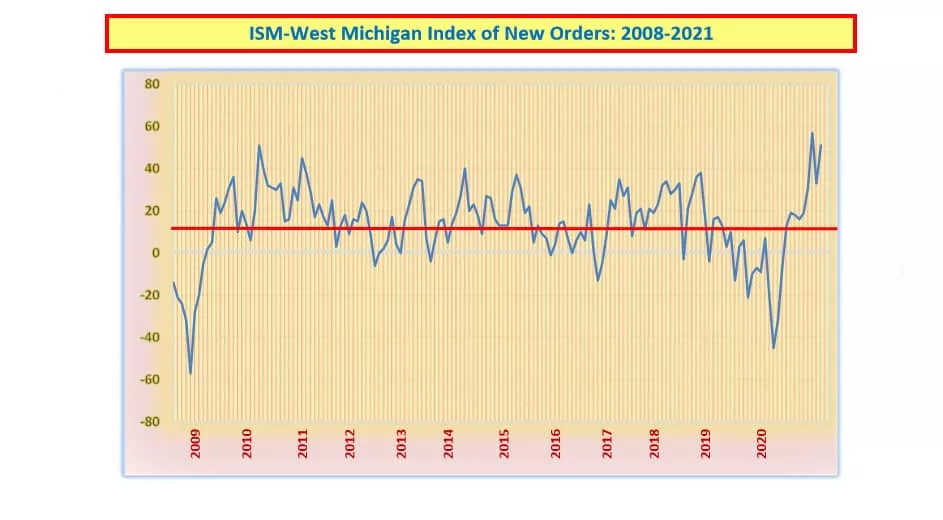

Dr. Long’s most closely watched index, the New Orders Index, an index of business improvement, rose to +51, up from February’s +33. In a more modest move, the Production Index, which is termed “output” by many economists, edged up to +33 from +28.

The esteemed professor says, “Because of the ongoing disruptions in the supply chains, and activity in the purchasing offices, our Purchasing Index jumped sharply to +51 from +23,” noting, “Much of the industrial market continues to experience spot shortages of a wide range of industrial commodities with no immediate end in sight.” Long reports this month’s Lead Times Index rose to a record of +83, which has, in turn, pushed the Pricing Index to record levels, while cautioning, “The continued success of the vaccine roll-out has resulted in a new wave of optimism, even though this pandemic by any measure is still far from over.”

Turning to specific industry sectors, Professor Long says that even though parts shortages continue to inhibit auto industry production, the auto sales report by Automotive News for the first quarter of 2021 greatly exceeded expectations. The Seasonally Adjusted Annual Rate for March posted at 16.5 million units, almost double the low point of 8.7 million units in April of 2020. According to the sales figures for 2021’s first quarter, much of the industry’s growth came from Hyundai-Kia, up 22.8-percent, Toyota rising 21.6-percent, Honda gaining 16.2-percent, and Nissan adding 10.8-percent. Sales growth for the Detroit three was much more modest. Year-over-year sales at Stellantis (formerly Fiat-Chrysler) rose 5.1-percent, followed by a 3.7-percent gain at GM and a scant 0.6-percent uptick from Ford.

Long offers some additional insight from Randy Parker, Senior Vice President for National Sales at Hyundai Motor America, who says: “Our fleet partners are looking for additional production. What that tells me is that the economy is rebounding, people are traveling again. A few months ago, the rental car companies saw an uptick in their urban rental business, but airport business was still depressed. Now their airport rental business is starting to pick up and they’re looking for cars. We’re going to support them as best as we can. Inventory is tight. We’re not immune to the semiconductor shortage. We’ve got relationships with the fleet companies and we’ve got model year 2021 contracts that we still have to honor. But now, they are looking toward the future with model year 2022, so we’re going to continue to work with our partners as best as we can. This semiconductor shortage is not going to be out there forever, hopefully.”

Turning to the world of employment, Dr. Long reports, “The national media has recently reported that the ‘headline’ rate of U.S. unemployment fell to 6.0-percent in March, down from 6.3-percent in February. In West Michigan, the March Employment Index came in at +40, a ten-year high.” Long explains, “In short, the industrial economy market remains on a roll, and the problem of finding enough people to fill the vacant positions remains a major concern for West Michigan as well as the rest of the U.S. industrial economy. In the most recent unemployment report from Lansing, we find the jobless rates for most of our local reporting units to be rising, although this situation appears to be temporary. The major segments of COVID-19 unemployment in West Michigan remain in the entertainment and hospitality industries, not the industrial firms. However, with the current high levels of consumer liquidity and bottled-up desire to resume travel, the summer could be very good for West Michigan’s resorts if they are able to open up safely.”

Looking at Industrial Inflation in West Michigan, Long looks back at the Industrial Lead Times Index which continues to set new records, adding, “So it was not a surprise to see the index rise to +83 from the previous record of +80. The tight supply has also resulted in our Pricing Index setting a new record at +85, up from +78. Most of our major big-ticket items like plastic resins, steel, copper, aluminum, and corrugated containers are rapidly rising in price, and the ability of many firms to pass the costs along has been limited.” Further explaining those concerns, Long says, “Digging into the causes for the continued disruption in the supply chains, we find that the transportation firms face the same labor shortages as our industrial firms. The U.S. customs backlog at most major ports also continues to limit timely delivery, and there is considerable criticism that our government has done little or nothing to alleviate the bottlenecks.”

Professor Long says that according to the forecasts now being disseminated by many of the major financial forecasters, 2021 is on track to post some of the strongest economic growth statistics in recent history. According to the Federal Open Market Committee of the Federal Reserve, the GDP for all of 2021 is now expected to increase 6.5 percent and then “cool off” in later years.

Scanning the horizon, Dr. Long shares his Short-Term Business Outlook Index for March, which asks local firms about the business perception for the next three to six months, reporting it rose nicely to +41 from +31. He notes, “In a more modest move, the Long-Term Business Outlook Index, which queries the perception for the next three to five years, edged up to +40 from +38. Both of these indexes are now at or near three-year highs.”

As has become standard practice to give a better feel for where survey participants heads are at, Professor Long includes a series of verbatim, but anonymous, anecdotal comments, some of which are shared here:

- “The stimulus checks are having some unintended consequences. The money is being spent on Amazon purchases resulting in a spike in demand for corrugated boxes. This is impacting the companies that ship their products in cases with longer lead times, and higher prices that will eventually be passed on to consumers.”

- “Finished good costs are rising due to increasing transportation costs, specifically on intermodal container shipments.”

- “Most commodity prices have increased, as have diesel fuel and gasoline which translates into higher transportation costs. Construction materials have also risen in recent months, especially steel and lumber.”

- “We are seeing pricing increases for machine tools. Most of our competitors have increased prices already, and many others are discussing price increases over the next few months. Most machine tool builders have low inventories at this time.”

- “A strong start would give us a good month, but activity is falling off as the end of the month gets near.”

- “These price increases are likely caused by recent Federal Government policy changes related to fossil fuels and international trade; they won’t likely change for the better very soon. Also, we have been in a hiring mode for 8 months and it has been a challenge. The unemployment rates are reported to be falling. However, many workers have taken themselves out of the employment market because they continue to be able to collect extended unemployment benefits. As a result, these people are not included in the labor pool for the purpose of determining the unemployment rates. In general, labor is minimally available, is very competitive, and is coming at a higher cost.”

- “We are still doing OK.”

- “We’re getting lonnnnnnng lead times from everyone due to high demand and rough transportation issues.”

- “We’re 30-percent above forecast this month. No major new projects, but a lot of MRO from the deep freeze down south.”

- “Demand is very strong, but raw material and labor shortages are limiting ability to increase production. We’re seeing pricing and cost increases in nearly every area.”

- “These are certainly unprecedented times, but our team is working hard to meet customer requirements.”

- “Labor, labor, labor. We’re investing in automation and process improvements heavily.”

- “The industry is a hot mess right now! It seems it will be bad for a couple more months.”

- “We continue to be impacted by some of the slowdown in the auto industry. We are hopeful the supply side catches up to current demand.”

- “Activity continues to improve.”

- “We continue to struggle getting enough people to meet our customer order demand.”

To see Professor Long’s complete report, click this link: gr-2021-04b