A veteran of many years in tracking the West Michigan industrial economy admits that he was actually surprised at the outcome of his April survey of manufacturers and suppliers across the region, saying the results were “down sharply, but not as bad as had been expected.”

That’s the overarching sentiment of Dr. Brian Long’s latest survey and the first in his series reflecting a full month during the coronavirus pandemic. Long is the Director of Supply Management Research at Grand Valley University in Grand Rapids, and he’s been conducting monthly surveys for four decades in the industrial sector across West Michigan taking the pulse of the people at the tops of those business organizations.

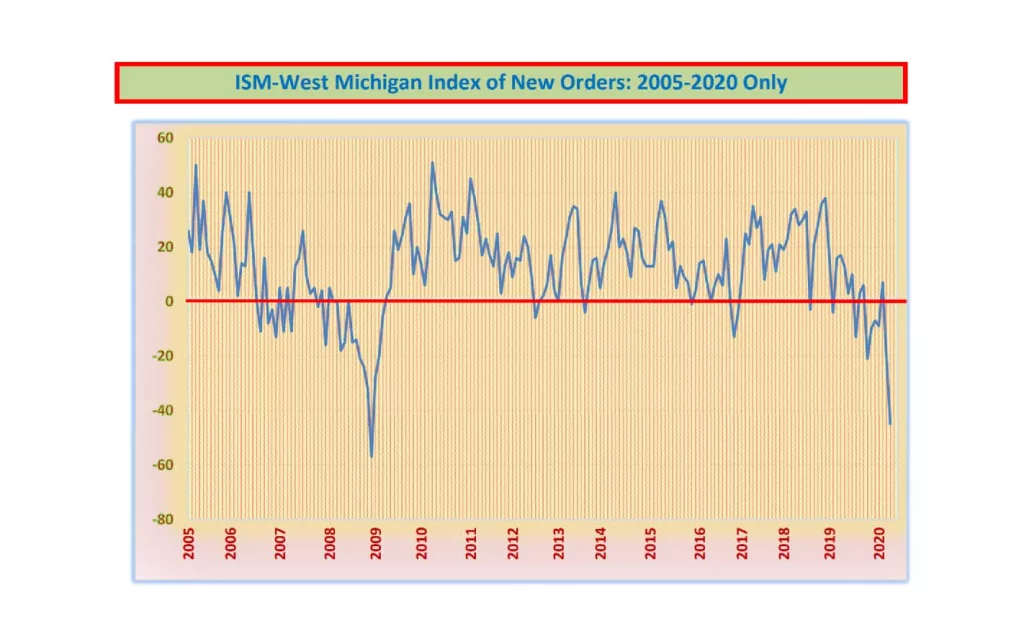

Long opens his new report by saying, “We expected our West Michigan April statistics to be negative, and this report is one of the weakest we have filed in our 40-year history. However, the data we collected in the third and fourth weeks of April did not turn out to be a record low.” He adds that his closely watched New Orders Index, which had already fallen to -21 in late March, fell further to -45 in April. He notes, however, that “At the onset of the Great Recession, this index fell to -59 in December 2008.”

Admitting that we’re early into the impact, Long says, “Granted, this recession is still in the early stages and could fall further in our next report. However, with some of our businesses beginning to reopen, we can hope that we have hit the bottom and can begin the slow process of recovery.” Professor Long says, as expected, his Production Index came in at -48, down from -16. The March Purchasing Index, which measures activity in the purchasing offices, fell to -44 from -30. Long was pleased that his survey was able to continue, even during the extensive stay home order, saying, “Thanks to modern technology, a considerable number of our survey respondents are now comfortably working from home. At least some work is still getting done, which is a good sign.”

Dr. Long briefly turns in his report to the bigger, overall U.S. picture, quoting Chris Williamson, Chief Business Economist at IHS Markit, as saying, “April saw the manufacturing sector struck hard by the COVID-19 pandemic, with output falling to an extent surpassing that seen even at the height of the global financial crisis. With orders collapsing at a rate not seen for over a decade, supply chains disrupted to a record degree and pessimism about the outlook hitting a new survey high, rising numbers of firms are culling payroll numbers. Consumer-facing businesses are being hit by slumping demand from households as April saw widespread lockdowns, but business spending on inputs and equipment has also tumbled as companies slash production and investment. Smaller firms are being hit the hardest, and also reporting the highest job losses, but large firms are also seeing the sharpest downturn on record. With infection curves showing signs of flattening, it is naturally hoped that the economic downturn will also bottom out. As restrictions are lifted, demand should gradually revive, but the trade-off between risking a second wave of infections and bringing the economy back to life looks set to be one of the greatest challenges faced by policy/lawmakers in recent history. The process will inevitably be led by caution, meaning recovery will also be frustratingly slow.”

In a sidebar, separate from his formal report, Dr. Long addresses several questions. He first asks, “What economic segments will be hurt the worst by this recession?” He responds by noting, “At the consumer level, three come to mind. First, we were already overbuilt by brew-pubs. Regrettably, many have not been around long enough to get far enough off the ground. Second, restaurants. Although many of the corporate and franchise units will survive, this is going to be a very rough time for the independents. Economic theory says that we should also look for a substantial round of price increases as restaurant spacing requirements limit store profitability margins. Third, high-end, high-margin retailers. This crisis has pushed many people to purchase on the web, and they will not all quit when the crisis is over.”

He also asks, “What industrial segments will suffer most?” His answers, “As always, our ‘cyclical’ industries, namely automotive parts producers, office furniture, aerospace, and capital equipment. These segments will all suffer; we just don’t know how much.”

Back at his formal report, and turning his attention to the automobile industry, Dr. Long says, “Had it not been for internet purchases, auto sales would have been virtually non-existent. Automakers and dealers have countered many of the lockdown measures with remote and online sales, but U.S. light-vehicle deliveries were expected to fall 50 to 55-percent in April, based on estimates from ALG, Edmunds, and Cox Automotive.” Looking ahead, Steven Center, Vice President of Automobile Sales at American Honda Motor, struck a more positive note: “There will be challenging days ahead as this very serious public health crisis continues, but with consumer traffic beginning to increase online and at Honda and Acura dealerships, we are approaching the coming weeks with guarded optimism.”

Turning to industrial inflation, Long says, “Despite the weakening economy, the decline in West Michigan index of pricds for April was less severe than anticipated. Because of a few apparent industrial shortages, some prices are still holding up, although the index dropped to -24 from -18.”

In the arena of future forecasting, Professor Long tells us, “As expected, West Michigan’s Short-Term Business Outlook for April, which asks local firms about the perception for the next three to six months, came in at -47, virtually unchanged from last month’s -46. However, the Long-Term Business Outlook Index, which queries the perception for the next three to five years, remained positive but edged slightly lower to +15, down from +22. In confirmation, U of M’s index of Consumer Sentiment fell from 89.1 to 71.0, the largest drop in the history of the survey. Consumer Confidence, a similar index from the Conference Board, fell from 118.8 to 86.9, also a record drop for one month.”

Summarizing his report, Long poses the question, “Is the worst over?” He answers, “With some businesses starting to reopen, we can hope that next month’s statistics will be less negative. However, it is worth remembering that it took 18 months (October 2007 to April 2009) for our survey to finally turn back to positive in the Great Recession. As the economy slowly reopens, we will be closely monitoring the confidence levels of both retail and industrial consumers, both of which have been hit very hard.” He concludes, “Like any recession, despite the efforts of the federal stimulus payments, many firms will not survive. At this early stage, assessing the survivors and losers is difficult.”

As is his tradition, Professor Long shares anonymous, verbatim anecdotal comments to flavor the thinking that goes into the numbers in his survey. Here are some of those comments shared in his April report:

- “Our company is currently shut down due to Covid19 and the state mandate.”

- “Quoting is still strong. Orders are about 60-70-percent of normal.”

- “We have increased inventory due to the uncertainty of supply base restrictions. So far, most vendors continue to run, and only a handful shut down. Our sales department is expecting a 20-percent decline for rest of calendar year. This seems optimistic.”

- “This has been a crazy month already. We were about to shut down for the stay-at-home order, but then we received a large package of tools for the medical battle against COVID-19. So, we are still open and operating at full strength to help in this fight.”

- “Employment is the same, but we have a lot of absentee employees with the COVID-19 stay-home order.”

- “We are shutdown since 3/23 per the governor’s executive order.”

- “It’s hard to gauge the industry right now with so many businesses down. We are looking forward to getting back to work and getting our manufacturing facilities up and running at full capacity.”

- “Sales are down for all business segments with the exception of medical. It is a bit of a challenge getting timely answers from suppliers with the amount of people working remotely, but we are not facing any critical supply issues. We have not laid off any workers but we do have a high amount of absences on a daily basis and overtime has been cut.”

- “Very odd times. We are an essential company, but our sales are down 20-percent. We are working to determine the impact to economy and company, but the variables are far reaching.”

- “It’s going to be a difficult time for a while.”

- “We have a horrible near-term business outlook, and will be down 50-percent.”

- “Times are very tight in the automotive market. We are hoping to see a rebound once things open back up in May….hopefully.”

- “We have seen some customers purchase equipment that are involved with the fight against COVID-19. Customers that are not involved with the fight (ventilators, hospital beds, etc) are very slow and pushing off purchases. Most believe the economy will recover. Most have strong balance sheets.”

- “We are preparing for 10-20-percent of our customer base to close shop. We will not be able to collect on past orders and will have a difficult year.”

- “Our cash position is relatively good. We will weather the storm, and maintain our current staff.”

- “This is bad. We have been deemed part of the critical supply chain infrastructure, but not a lot of our customers have. Business is VERY bad, and we are off at least 50% of normal.”

- “We are getting what we need to complete our machinery. Most all of my suppliers are considered at least ‘essential’ and are open.”

- “Most machine tool builders are discounting heavily in order to keep factories running.”

- “Steel is the big thing down in price. We have great suppliers wanting to do their part during this crisis and they are giving us rock bottom pricing for any steel we buy for medical molds for COVID-19.”

- “We still have all employees working, but they are all on reduced hours.”

- “COVID-19 has certainly impacted manufacturing. We are fortunate that we are an essential supplier and are still working, but certainly less volume.”

- “For our firm, demand is up due to Covid-19.”

You can see Professor Long’s complete report by clicking the link below: