Fueled by strong loan growth, acquisition and expansion, Horizon Bancorp and it’s Horizon Bank saw net income rise by more than 24-percent even after taking out acquisition-related expanses in the bank’s second quarter 2017 results. In fact, net income for the second quarter increased 43.4-percent to $9.1-million, or 41-cents per diluted share as compared to $6.3-million, or 35-cents per diluted share in the same time frame a year ago.

Horizon Chairman & CEO Craig Dwight says, “Horizon continued to expand upon its growth story during the second quarter of 2017 with the announcement of two acquisitions, solid organic loan growth, the opening of a full-service branch in Grand Rapids, and a loan production office in Dublin, Ohio, a vibrant suburb of Columbus, Ohio.” Dwight notes, “Additionally, Horizon Bank converted from a national bank to an Indiana state-chartered non-member bank during the quarter which should result in a pre-tax cost savings of approximately $432,000 annually.” He adds, “A portion of the cost savings from the charter conversion will be allocated to the state bank associations and expanded internal audits.”

The Michigan City-based financial institution announced unaudited financial results Thursday showing that net income for the first six months of 2017 clocked in at $17.3-million, or 77-cents diluted earnings per share as compared to $11.7-million or 64-cents per diluted earnings per share in the same time period of 2016.

Core net income for the first six months of the year increased by 30.7-percent to $16.1-million or 71-cents diluted earnings per share as compared with $12.3-million or 68-cents diluted earnings per share for the same time frame in 2016.

Horizon’s return on average assets climbed to 1.12-percent for the second quarter of 2017 as compared to 0.94-percent for the same period in 2016.

Commercial loans, excluding acquired commercial loans, increased by an annualized rate of 13.4-percent or $71.1-million during the first six months of the year, which consumer loans using the same parameters rose by an annualized rate of 25.9-percent in the same time frame.

CEO Dwight says, “Horizon experienced strong loan growth during the first six months of 2017, primarily in commercial and consumer loans.” He adds, “Our growth markets of Fort Wayne, Grand Rapids, Indianapolis and Kalamazoo, combined to produce total loan growth of $83.1-million during this time period.”

Dwight concludes, “We believe Horizon is well-positioned to continue our growth story by strengthening our existing market share and capitalizing on the recent investments in our growth markets.”

Horizon’s tangible book value per share rose to $12.20 at June 30, 2017, as compared to $11.48 at December 31st, 2016.

Just last month, Horizon’s board announced approval of both an 18-percent increase in the company’s quarterly cash dividend from 11-to-13-cents per share, payable this past week to shareholders of record on July 7th, and their pending acquisition of Wolverine Bancorp and Wolverine Bank of Midland, Michigan.

Horizon’s Grand Rapids loan production office also converted into a full-service branch during the second quarter.

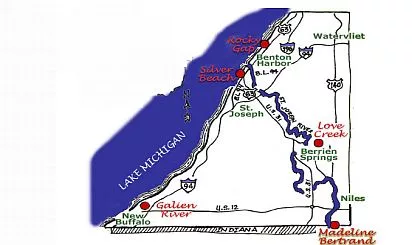

Horizon has multiple branch operations around Berrien County and beyond, and continues to seek out growth opportunities through acquisitions.