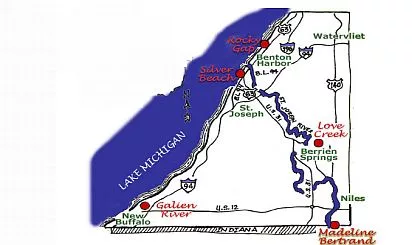

The man whose key job is to continually attract new business to Michigan’s Great Southwest in direct balance with his drive to keep those companies that are already here happy and competitive, will be the first to admit that he wishes the Michigan Legislature’s action this week on the Good Jobs for Michigan bills would never have been needed in the first place.

Cornerstone Alliance President Rob Cleveland says, “I believe if you ask most Economic Developers, they’d tell you they would prefer to live in a world where incentives played no part in company location. I would like to live in that world. But, that is not the word we live in.”

I asked Cleveland for his opinion of the somewhat controversial bills headed to Governor Rick Snyder’s desk which would allow those large companies and employers creating thousands of jobs to keep personal income taxes generated by those same new jobs as an incentive to locate in Michigan. He tells me that Cornerstone is grateful for the work of Senator John Proos and State Representative Kim LaSata in supporting “all of the economic development related legislation.” He adds, “There is no doubt that their work in this session will create more jobs, more investment and attract new companies to the state of Michigan.”

The uniquely-named Good Jobs for Michigan bills, a three-bill package, all passed the State House by a margin of 71-35 yesterday afternoon, dispatching it next to Snyder’s desk after having passed the Senate before the 4th of July recess, but showing signs of stalling. Snyder himself said, “Michigan has been a tremendous economic comeback in the past six years, and passage of this legislation sends the signal that we are pressing forward to ensure the strongest possible future.” Snyder says, “Where before we were complacent and our economy centered around the Michigan Business Tax and a broken tax code, including an overabundance of tax credits, we are now enacting forward-thinking policies that make us more competitive for new jobs and industries in a fiscally responsible fashion.”

Locally, Cornerstone Alliance, Kinexus and others had voiced support for the legislation joining other organizations like the Business Leaders for Michigan, Southwest Michigan First, and both The Right Place Inc, and the Grand Rapids Area Chamber of Commerce.

Cornerstone’s Cleveland says the legislation, “Is about maintaining a competitive playing field. The State of Michigan has done an excellent job of becoming a well-run, low-cost, low-risk state where companies can locate and know they will have consistent, stable state government.” He quickly adds, “However, in today’s ultra-competitive environment, that simply isn’t enough. The Good Jobs legislation, along with the earlier passed Transformational Brownfield legislation, give us tools to compete with states like Tennessee, South Carolina and Indiana, who offer large incentives and similar, low-cost environments.”

Cleveland explains that the legislation that was passed, “simply gives Michigan communities the opportunity to complete on a level playing field. Companies that are eligible for the incentive need to create at least 250 new jobs and pay wages 25% above the regional average.”

Often times when incentives come into play, critics argue that government is picking winners and losers. Cleveland counters that sharply saying, “It’s important to note that government doesn’t pick winners and losers; a company does. This legislation means Michigan communities will see more opportunities to bring new jobs to our state and Cornerstone Alliance will be working to ensure that Michigan’s Great Southwest sees more than our fair share.”

The legislation is not, however, without its critics. the Michigan Chapter of the National Federation of Independent Businesses expressed their disappointment in it with Executive Director Charlie Owens saying, “Michigan small business owners have seen enough of ‘good jobs’ promises through targeted tax incentives to know they don’t work.” Owens adds, “It is disappointing to see the governor and legislature drift back toward these quick fix economic development programs while broad based overall tax reform has been proven to be the better approach.”

According to Owens, the bills would create a new scheme of diverting tax revenue from employer payroll withholding to companies that promise to create jobs and are approved by the Michigan Strategic Fund. He says, “While we do not doubt the good intentions behind this legislation, they are a distraction and departure from the successful fiscal policies that have dramatically improved Michigan’s overall economic climate for all businesses and citizens of our state.”

Owens contends, “Companies lured into the state by targeted tax incentives often end up being direct competitors to established businesses that have been in the state for years providing jobs and paying taxes without special treatment or tax breaks.”

Meanwhile, Michigan Freedom Fund Executive Director Tony Daunt responded to the bills’ passage saying, “We are extremely disappointed in self-described conservatives in the state House who refused to approve income tax relief for everyday Michigan workers and instead, voted for crony capitalist tax giveaways to a few handpicked big businesses.” He argues, “Governor Snyder and the legislature continue picking winners and losers – a few well connected businesses win, Michigan taxpayers lose.”

Governor Snyder was expected to sign the bills into law before the week is out.