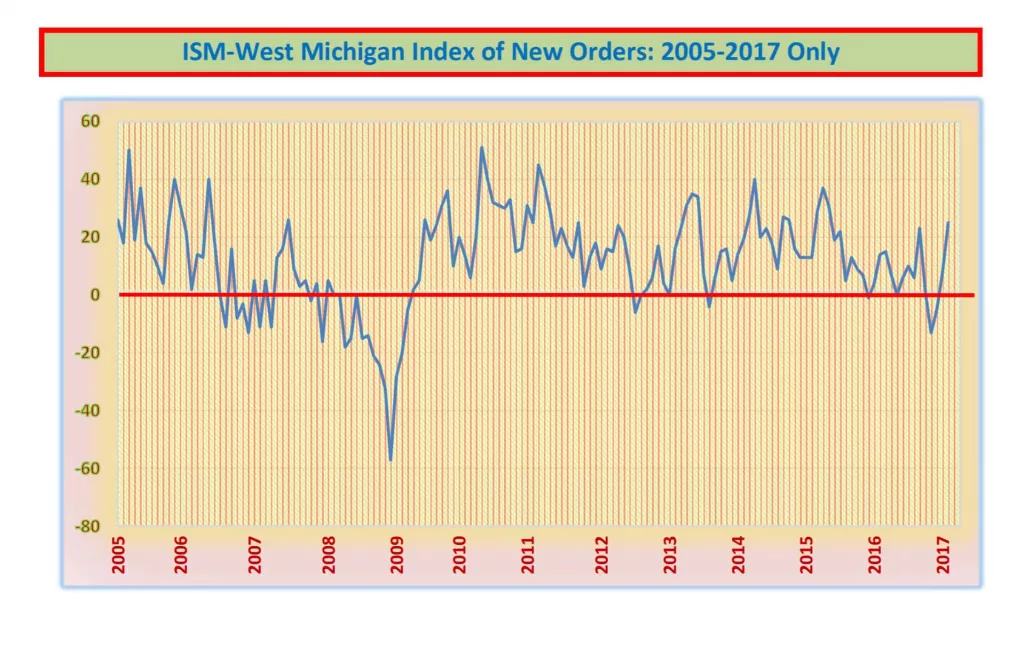

With the New Orders Index now at its highest level in nearly three years, the 2017 rally continues for the West Michigan Industrial Economy. That’s the current snapshot provided by Professor Brian Long, Director of Supply Chain Management Research at Grand Valley State University as he tabulates results of his February manufacturing sector survey.

Dr. Long publishes a monthly Current Business Trends report under the flag of the Institute for Supply Management in Grand Rapids which studies the West Michigan industrial economy for signals of feast or famine. He tells us this week that his report for the final two weeks of February show that “We have again been blessed with a significant improvement in our statistics,” adding, “Almost every day, the news media refers to the records in the stock averages as the ‘Trump Rally.’ Fortunately for us, at least some of this optimism has carried over to the industrial market.”

Long suggests that for the industrial markets, the main driving factor continues to be the possibility of a significant cut in the statutory 35-percent corporate tax rate. He says, “If this tax cut does come to pass, the impact will be huge.”

Long’s survey produced a New Order Index for February, measuring business improvement, which bounced to +25, a significant leap from the +8 in January’s “back to work” attitude. The Production Index also rocketed to +17 up from +8 in the prior month, with activity on the Purchasing Index produced a +19 jump from the +6 reading in January.

The Finished Goods Index edged up to +5 from a zero reading, while the fear of more price increases drove the Raw Materials Inventory Index raced to +21, nearly double the January reading of +11.

Long tells us, “All of this bodes well for the overall West Michigan economy for the first quarter of 2017.” In fact, he says, “If March turns out to be as good as February, the Gross Domestic Product for the first quarter of 2017 should be very positive.” Long also notes, “Although many of our industrial groups are showing signs of topping out, the overall West Michigan economy should still remain positive for the foreseeable future.”

When Long turns the spotlight onto individual market sectors, he says that auto parts suppliers continue to raise concern over the recent softening in auto sales, but remain positive about the 2017 outlook. “For the office furniture industry,” he writes, “A few of the firms are continuing to set sales records, although many signs still point toward sales topping out.” Long says the Capital Equipment rally which started in January is still moving forward, while the performance by industrial distributors continues to be positive for some firms, but others are seasonally stagnant.

Long says that following the pattern of improving sales and production numbers, it is not surprising to see the business sentiment numbers for February continue to improve. The Short Term Business Outlook, which looks at the next three to six months, rose to +37 from +28, while the Long Term Business Outlook remained unchanged at +47 when scanning the next three to five years. As Long notes, “All of this reflects a noticeable improvement over the pre-election statistics a few months ago.”

Professor Long also points to February’s rising Employment Index which doubled from the previous +6 up to +12, as double digit growth for that index has returned for the first time since August.

Long says, “In summary, most of our state, local, and national statistics continue to improve.”

Long, as has become tradition, includes anonymous verbatim comments from survey participants, and here is a random sampling of those:

- Orders are steady, but we’re looking for more employees.”

- “Tool & Die shops remain busy and are slowly warming to new capital equipment to help fill the orders they have. Our fabrication equipment is doing well, but competition is tough on pricing.”

- “We have a good start to 2017.”

- “Automotive remains strong. Sales would be stronger if we could produce to what is needed. Many larger drop-in orders from customers have been coming in pretty heavy this new year.”

- “We’re seeing lots of first-of-the-year incremental increases.”

- “No change since last month.”

- “2017 is looking stronger than we first thought based on the last quarter of 2016.”

- “We are jogging along fat & happy. We are expecting 2017 to be another good year for us.”

- “Sales continue to grow and our backlong is larger than it has been in years.”

- “Orders are slow right now, but quotes are high for this time of year.”

- “Business is good, and I think it will stay that way for a while. A lot of our customers have launched projects that require a huge capital investment. They wouldn’t do that if they were concerned about the near future.”

- “We have a steady start to the new year. It’s not amazing, but consistent.”